Introduction

Managing personal finances has become more important than ever in today’s fast-paced digital world. With rising living costs and multiple income streams, having a reliable budgeting method is no longer optional. This is where gomyfinance.com create budget comes into play, offering a structured and user-friendly approach to tracking income, expenses, and savings goals. Whether you are a beginner or someone looking to improve financial discipline understanding how gomyfinance.com helps create a budget can transform your financial future.

Understanding the Concept Behind gomyfinance.com create budget

The idea behind gomyfinance.com create budget is simple: give users control over their money without overwhelming them. Unlike traditional spreadsheets or complicated financial apps, this platform focuses on clarity, automation, and practical financial planning.

Budgeting is not just about cutting expenses; it’s about aligning your spending with your priorities. gomyfinance.com allows users to visualize their finances clearly, helping them make informed decisions based on real data rather than guesswork.

Why Budgeting Is Essential in Modern Financial Planning

Before diving deeper into gomyfinance.com create budget, it’s important to understand why budgeting matters. A proper budget helps you:

-

Track where your money is going

-

Identify unnecessary expenses

-

Build emergency savings

-

Reduce financial stress

-

Achieve long-term goals faster

In a world where digital payments dominate, expenses often go unnoticed. A smart budgeting tool bridges that gap by offering transparency and accountability.

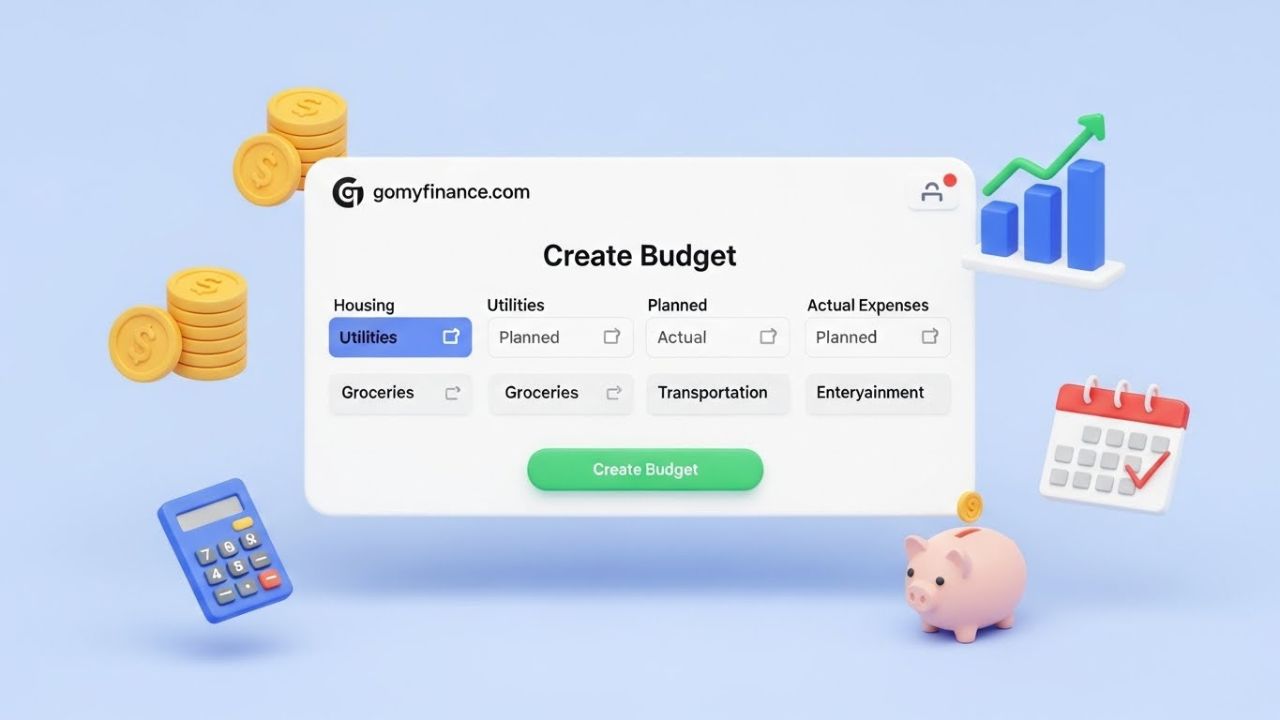

How gomyfinance.com create budget Works Step by Step

Setting Up Your Financial Profile

The first step in gomyfinance.com create budget is creating a personalized financial profile. Users input basic information such as income sources, monthly expenses, and financial goals. This step ensures the budget is tailored to individual needs rather than following a generic template.

Categorizing Income and Expenses

A standout feature of gomyfinance.com create budget is its detailed expense categorization. Users can separate fixed expenses like rent and utilities from variable costs such as groceries, entertainment, or travel. This clarity helps in spotting spending patterns and areas that need adjustment.

Smart Budget Allocation

Once income and expenses are entered, the system automatically suggests budget allocations. This smart feature ensures that savings, necessities, and discretionary spending are balanced realistically. Instead of forcing unrealistic limits, the platform adapts to your lifestyle.

Key Features That Make gomyfinance.com create budget Unique

User-Friendly Interface

One of the biggest advantages of gomyfinance.com create budget is its clean and intuitive design. Even users with no financial background can navigate the platform easily. Clear dashboards and visual summaries make budgeting less intimidating.

Real-Time Financial Insights

With real-time tracking, users always know where they stand financially. The gomyfinance.com create budget system updates spending data instantly, reducing the chances of overspending and missed payments.

Goal-Based Budgeting

Financial goals vary from person to person. Some aim to save for a house, while others focus on clearing debt. gomyfinance.com create budget allows users to set short-term and long-term goals, integrating them seamlessly into the monthly budget.

Benefits of Using gomyfinance.com create budget for Financial Growth

Improved Saving Habits

Consistent budgeting naturally improves saving behavior. By using gomyfinance.com create budget, users become more mindful of daily spending and develop healthier financial habits over time.

Better Debt Management

Debt can be overwhelming without a clear plan. The platform helps prioritize repayments, ensuring high-interest debts are addressed first while maintaining essential expenses.

Reduced Financial Anxiety

Knowing exactly how much money you have and where it’s going provides peace of mind. gomyfinance.com create budget removes uncertainty, allowing users to plan confidently for the future.

Who Should Use gomyfinance.com create budget?

Students and Young Professionals

For those just starting their financial journey, gomyfinance.com create budget offers a simple yet effective way to learn money management without complexity.

Families and Households

Families juggling multiple expenses can benefit greatly from structured budgeting. The platform ensures that household needs, savings, and emergencies are all covered.

Freelancers and Self-Employed Individuals

Income fluctuations can make budgeting challenging. gomyfinance.com create budget adapts to variable income, helping freelancers plan smarter during both high-earning and slow months.

Tips to Maximize Results with gomyfinance.com create budget

-

Review your budget weekly instead of monthly

-

Adjust categories as spending habits change

-

Set realistic savings goals

-

Use past data to improve future planning

-

Stay consistent even during low-income periods

These practices enhance the effectiveness of gomyfinance.com create budget, ensuring long-term financial stability.

Common Budgeting Mistakes and How gomyfinance.com Helps Avoid Them

Many people fail at budgeting due to unrealistic expectations or lack of tracking. gomyfinance.com budget addresses these issues by providing automated insights and reminders, helping users stay on track without manual effort.

Another common mistake is ignoring small expenses. The platform highlights micro-spending patterns, showing how small costs add up over time.

The Future of Digital Budgeting with gomyfinance.com create budget

As financial technology continues to evolve, budgeting tools are becoming smarter and more personalized. gomyfinance.com budget reflects this trend by focusing on simplicity, adaptability, and real-world usability. With regular updates and improved analytics, the platform is well-positioned to remain relevant in 2026 and beyond.

Final Thoughts

In an era where financial uncertainty is common, having a reliable budgeting system is essential. gomyfinance.com budget offers a modern, user-friendly solution for anyone looking to take control of their finances. By combining smart automation with practical budgeting principles, it empowers users to make confident financial decisions and build a secure future.